When Strong Businesses Don’t Fit Bank Boxes

A profitable business should not be denied financing.

Yet I watch it happen every week.

Owners generating $2 million, $5 million, even $12 million in annual revenue walk into a bank confident — and walk out confused. Deposits are strong. Contracts are signed. Growth is visible. But the tax return shows lean net income because the owner reinvested aggressively, depreciated equipment, or optimized for taxes.

The bank doesn’t underwrite momentum. It underwrites paperwork.

That disconnect is costing serious business owners real estate opportunities, equity growth, and strategic control.

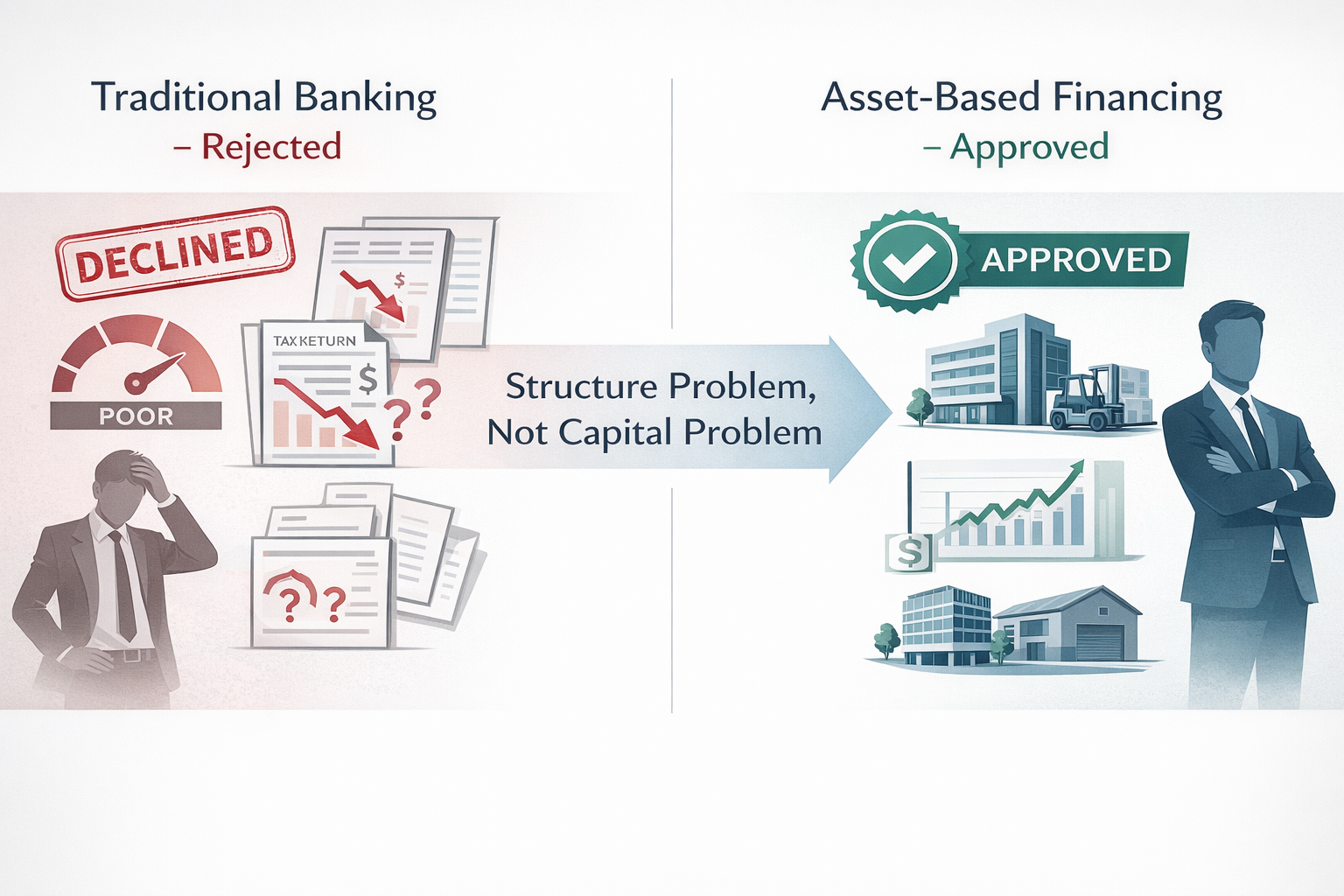

From where I sit as an asset-based lending expert, this isn’t a credit problem. It’s a box problem. Traditional underwriting was designed for salaried predictability, not entrepreneurial volatility.

Here’s the shift: Non-QM real estate lending is not “alternative.” It’s structured flexibility that evaluates how your business actually performs.

In 2026, understanding that difference may determine who controls their property — and who keeps waiting for approval.

If you’re building a business between $500K and $20M in revenue, this is capital strategy you cannot afford to misunderstand.

CEO Takeaways

• Bank denials often reflect documentation structure — not business weakness.

• Tax efficiency can unintentionally suppress borrowing capacity.

• Real estate control is a strategic asset, not just a financing decision.

• In 2026, underwriting flexibility may separate expanding owners from stalled ones.

Why Traditional Lending Misses Growing Owners

Traditional lending is built around consistency. Predictable W-2 income. Stable year-over-year net profit. Clean entity structures.

Growing businesses rarely look that way.

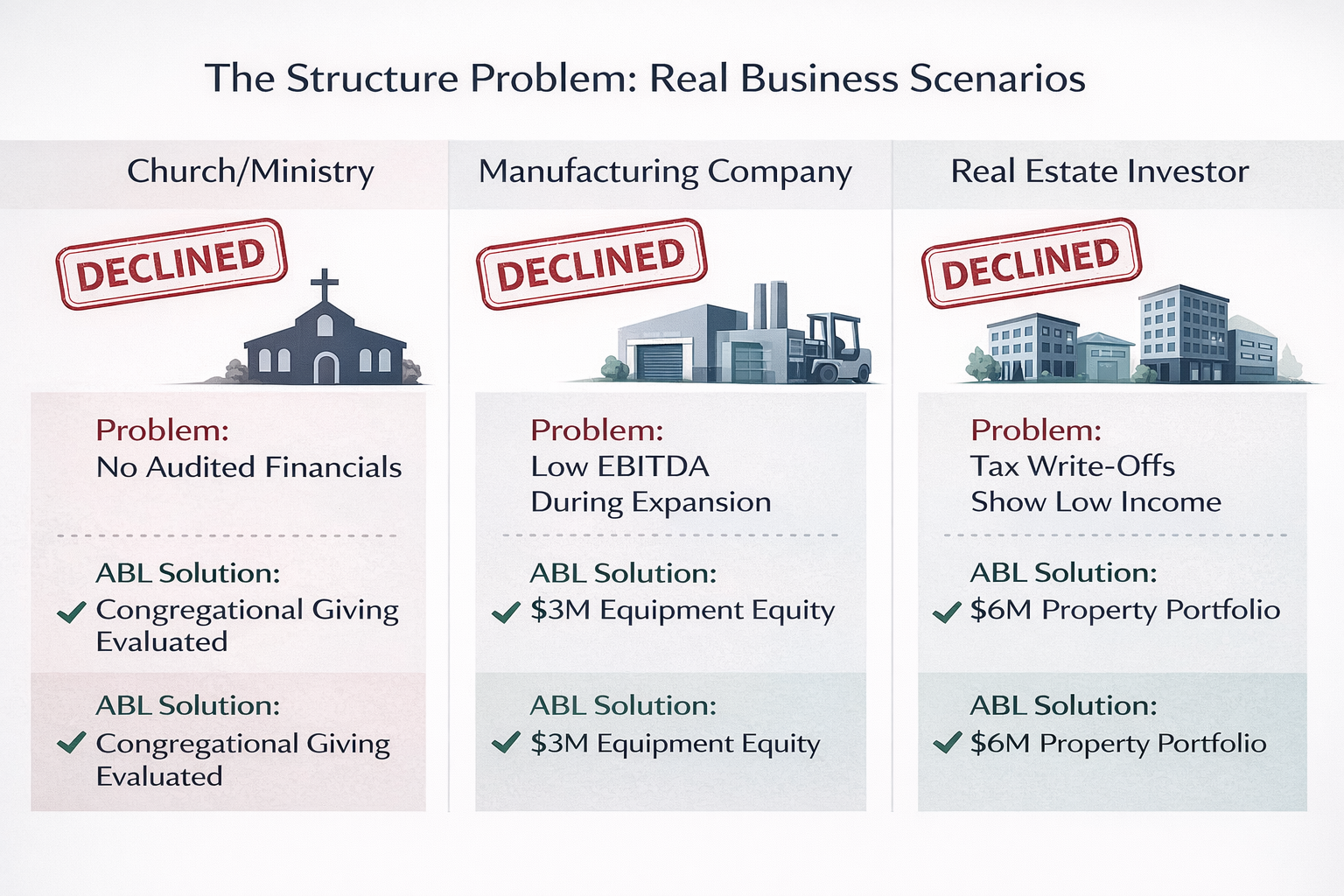

I work with owners who deliberately lower taxable income. They accelerate depreciation. They expense equipment. They reinvest profits into hiring, marketing, or inventory. On paper, net income shrinks. In reality, the business strengthens.

Banks underwrite the paper.

Then there’s entity complexity. Many owners operate multiple LLCs — one for operations, one for real estate, another for equipment. Cash flows between entities for legitimate tax and liability reasons. To an underwriter applying rigid guidelines, that complexity becomes friction.

And in 2026, friction is increasing.

Credit tightening. Overlay adjustments. Heightened documentation scrutiny. Even strong borrowers are facing narrower approval margins as banks protect balance sheets.

The result is predictable:

When documentation doesn’t reflect real performance, financing stalls.

That’s not because the business lacks capacity. It’s because the underwriting model wasn’t built for entrepreneurial growth cycles.

This is precisely where structured flexibility — including Non-QM programs — becomes relevant.

CEO Takeaways

• Tax efficiency can reduce reported income but not real cash flow.

• Reinvestment strengthens businesses — but can weaken traditional loan approvals.

• Multiple entities add protection, yet complicate conventional underwriting.

• As bank overlays tighten in 2026, flexible documentation strategies become critical.

• If paperwork misrepresents performance, you need financing aligned with reality.

The Core Non-QM Programs Small Business Owners Should Understand

When I evaluate Non-QM for an owner, I’m not looking for a workaround. I’m looking for alignment — between how the business actually performs and how the lender evaluates risk.

Here are the programs that matter most in 2026.

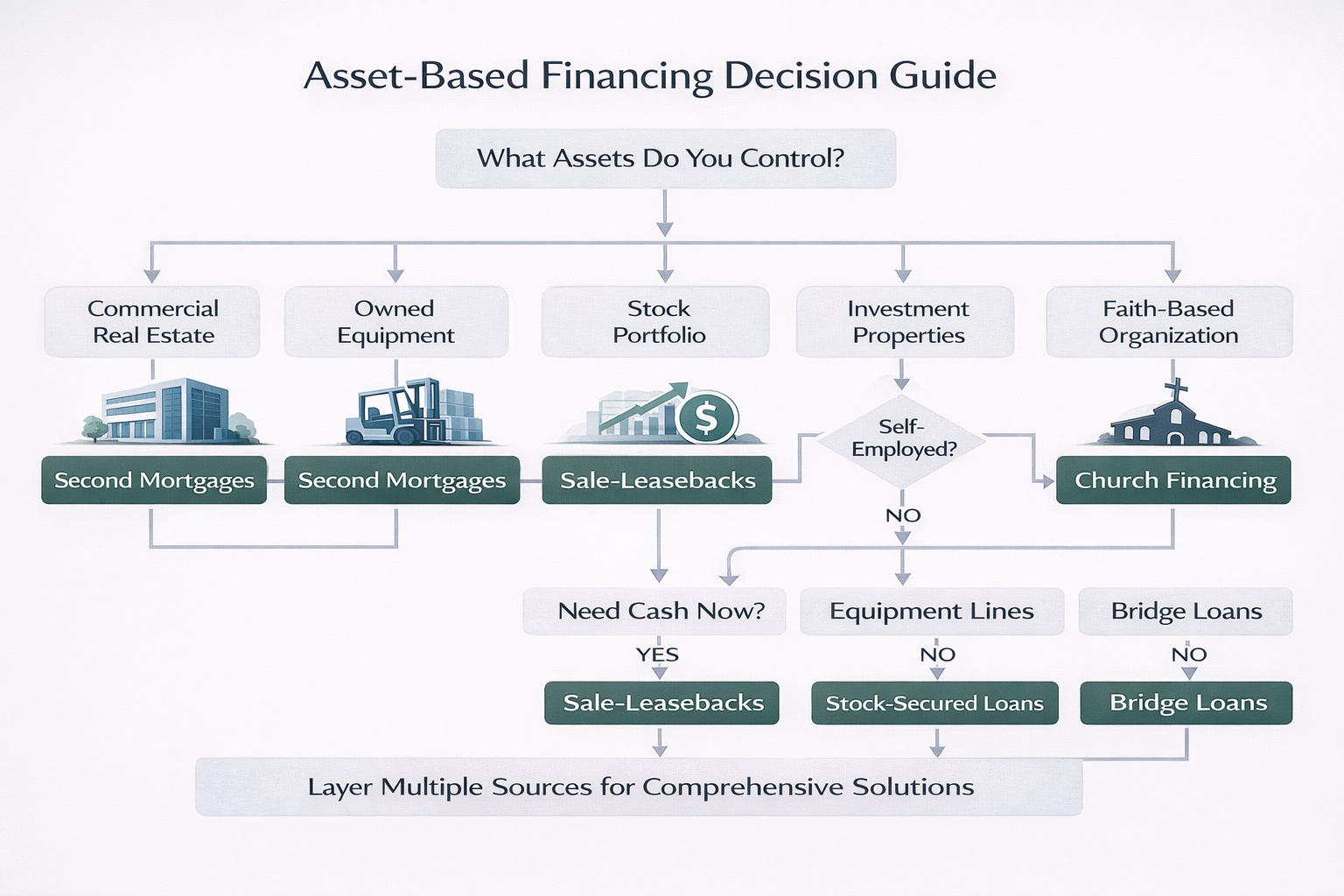

A. Bank Statement Loans

Bank statement programs are often the cleanest solution for self-employed owners.

Instead of underwriting off tax returns, the lender reviews 12–24 months of business (or sometimes personal) deposits. The focus shifts from reported net income to actual cash flow behavior. If deposits are consistent and the expense ratio is reasonable, qualification becomes far more realistic.

I’ve used bank statement loans for contractors, medical practices, logistics firms, and professional services businesses that show strong monthly inflows but limited taxable income.

Use case: purchasing or refinancing an owner-occupied building while preserving working capital inside the company.

This program rewards operational strength — not tax optics.

CEO Takeaways

• Deposits often tell a truer story than tax returns.

• Strong cash flow consistency improves approval odds.

• Ideal for owner-occupied property acquisitions.

• Aligns financing with business reality, not accounting strategy.

B. P&L Only Loans

P&L programs work well when growth has accelerated recently.

Instead of relying solely on filed tax returns, lenders may accept a CPA-prepared profit and loss statement to reflect current performance. This shortens the look-back window and captures momentum that hasn’t yet shown up in prior filings.

For fast-growing companies — especially those expanding revenue quickly — this flexibility can be critical.

Strategic fit: businesses scaling rapidly where the prior tax year understates present earning power.

I view this as momentum underwriting.

CEO Takeaways

• Rapid growth may not be visible in last year’s tax return.

• CPA-prepared P&L can capture current performance.

• Useful for expansion-stage businesses.

• Financing should reflect today’s numbers — not last year’s snapshot.

C. DSCR Loans

DSCR (Debt Service Coverage Ratio) loans shift the focus away from the owner entirely.

Here, the property qualifies based on its own rental income. If the property’s cash flow sufficiently covers the proposed mortgage payment, approval becomes possible — regardless of the borrower’s personal income structure.

For business owners acquiring mixed-use buildings, warehouses with rental components, or standalone investment properties, this structure is powerful.

Capital strategy angle: you build real estate equity while preserving liquidity inside your operating company. The property carries itself.

That separation is strategic. It keeps your business capital intact while your real estate grows independently.

CEO Takeaways

• Property cash flow can qualify the loan.

• Owner income becomes secondary.

• Strong fit for investment or mixed-use real estate.

• Enables equity growth without draining business liquidity.

D. Standalone Second Mortgages

This is one of the most overlooked capital tools available.

A standalone second allows you to access equity without refinancing your existing first mortgage. If you locked in a strong rate two or three years ago, you preserve it. You don’t disturb the first lien.

Instead, you tap a portion of available equity as structured liquidity.

Use case: funding inventory, equipment, expansion, or short-term working capital — without selling ownership or restructuring existing debt.

From a capital efficiency standpoint, this is intelligent layering. You optimize what you already own.

CEO Takeaways

• Access equity without touching your low first-lien rate.

• Avoid unnecessary refinancing risk.

• Generate liquidity without equity dilution.

• Strong tool for expansion capital.

E. ITIN Programs

Entrepreneurship does not require a traditional SSN profile.

ITIN programs expand access to real estate financing for borrowers without standard Social Security documentation. These programs evaluate credit behavior, income documentation, and asset strength within structured guidelines.

I’ve seen immigrant entrepreneurs build exceptional businesses yet struggle with conventional mortgage qualification. This structure acknowledges real economic contribution.

It’s inclusion through underwriting design.

CEO Takeaways

• Real estate financing is possible without traditional SSN documentation.

• Expands access for entrepreneurial business owners.

• Structured flexibility — not lowered standards.

• Ownership control remains the objective.

Each of these programs serves a different strategic purpose. The key is not choosing the “easiest” option. It’s choosing the structure that aligns with how your business truly performs and where you intend to grow.

Why Non-QM Is a Capital Structure Decision — Not a Last Resort

I want to challenge the narrative right here.

Non-QM is not what you use when you “can’t qualify.”

It’s what you use when you understand capital structure.

Too many business owners treat financing as a pass/fail test administered by a bank. Approval becomes validation. Denial becomes discouragement. That mindset gives the bank too much control over your growth timeline.

From where I sit, Non-QM is a structural choice.

-It protects equity.

-It avoids bringing in outside investors prematurely.

-It allows you to acquire or refinance real estate without diluting ownership in your operating company.

If your business generates strong deposits but optimizes taxable income, your financing structure should reflect that reality. If your growth trajectory doesn’t fit a conventional underwriting box, the box shouldn’t dictate your strategy.

Smart owners use tools intentionally.

Reactive owners wait for approval.

The difference is control.

In 2026, the businesses that expand intelligently will be the ones that understand financing as architecture — not permission. Non-QM programs are simply one more lever in a disciplined capital plan.

CEO Takeaways

• Financing is a capital structure decision — not a validation test.

• Non-QM can preserve equity and prevent unnecessary dilution.

• Control over property equals control over long-term leverage.

• Underwriting should align with real performance, not rigid templates.

• Strategic owners choose tools; reactive owners wait for approval.

Two Real-World Scenarios

Let me make this practical.

Scenario One:

A contractor generating roughly $4 million in annual revenue wanted to purchase the warehouse he had been leasing for years. Deposits were strong. Backlog was healthy. But taxable income was compressed due to equipment write-offs and aggressive reinvestment.

The bank focused on net income. The numbers didn’t fit.

We structured a bank statement loan instead. Underwriting evaluated 24 months of consistent business deposits, not paper-adjusted profit. He closed on the warehouse, fixed his occupancy cost, and began building equity in an appreciating asset.

The capital outcome:

He converted rent into ownership without draining operating liquidity.

Scenario Two:

A retailer doing $2.5 million annually had locked in an attractive first mortgage rate two years prior. Business was expanding, and inventory needs were increasing ahead of peak season. Refinancing the entire property would have meant losing that favorable rate.

Instead, we layered a standalone second mortgage. The first lien remained untouched. The retailer accessed structured liquidity tied to existing equity and used it to expand inventory and improve vendor terms.

The capital outcome:

Growth was funded without selling equity or disturbing low-cost debt.

CEO Takeaways

• Strong deposits can unlock ownership even when taxable income is lean.

• Real estate equity can fund growth without refinancing everything.

• Preserving low-rate debt is often smarter than restructuring it.

• Capital structure decisions should enhance flexibility — not create friction.

Risks, Discipline & When Non-QM Is Not Ideal

Non-QM is a tool — not a shortcut.

Rates may be higher than conventional bank products. That’s the tradeoff for underwriting flexibility. If you qualify cleanly for a traditional QM mortgage at the lowest possible rate, you should absolutely compare the economics carefully.

Loan-to-value limits can also be tighter. Lenders want meaningful borrower equity in the deal. Strong deposits and documented cash flow consistency matter. If revenue is volatile or deposits swing wildly month to month, approval becomes more difficult.

And this is important: Non-QM is not rescue capital for distressed borrowers. It works best for fundamentally healthy businesses that simply don’t fit conventional underwriting boxes.

From my perspective, discipline is everything. The structure must make strategic sense. The cost of capital must align with the return on the property or the growth it supports.

Flexibility without discipline becomes expensive.

Used correctly, Non-QM enhances capital structure. Used carelessly, it compresses margins.

CEO Takeaways

• Compare cost of capital carefully — flexibility has a price.

• Expect realistic LTV limits and equity requirements.

• Consistent deposits strengthen approval probability.

• Non-QM supports healthy businesses — not distressed situations.

• Capital tools require discipline, not urgency.

Final Thoughts : 2026 Rewards Owners Who Understand Capital Structure

I’m watching two trends move in opposite directions.

Banks are tightening. Documentation standards are hardening. Credit committees are becoming more conservative as balance sheets are protected and risk models recalibrated.

At the same time, alternative underwriting is expanding — becoming more structured, more institutional, and more aligned with how real businesses actually operate.

That divergence creates opportunity.

The owners who win in 2026 won’t be the ones waiting for approval. They’ll be the ones who understand how their capital is structured — and how real estate fits into that architecture.

Control matters.

Equity matters.

Liquidity matters.

Real estate is not just an asset. It is leverage, stability, and long-term strategic positioning.

Review your real estate position.

Understand your options.

Structure capital intentionally.