INTRODUCTION

Last Tuesday, a manufacturing CEO called me about a $2M equipment loan denial. His EBITDA looked weak on paper—growth phase, heavy reinvestment; you know the drill. Banks saw the numbers and ran. Here's what they missed: He owned $4.3M in paid-off machinery sitting on his balance sheet. The capital was there. The structure wasn't.

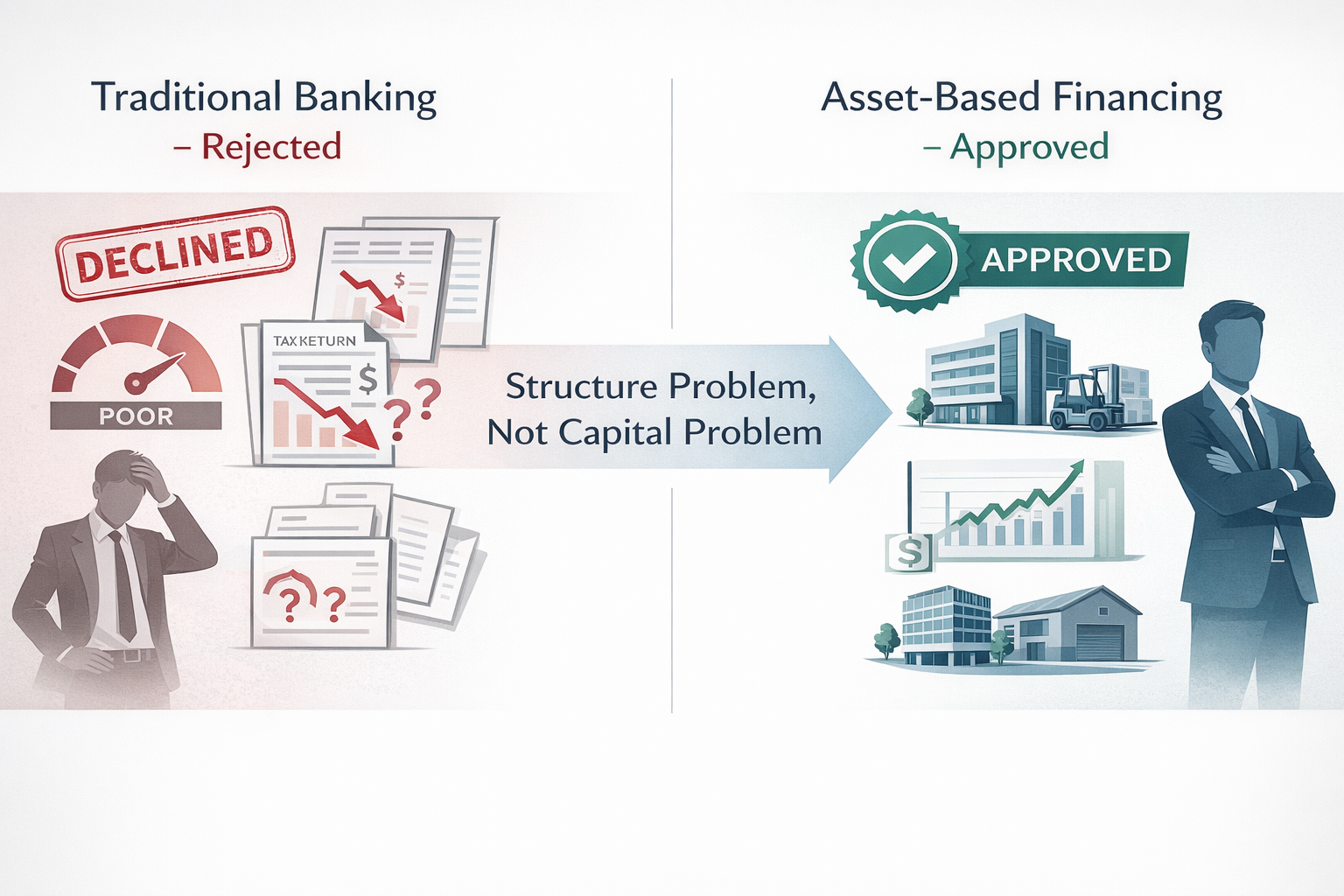

Most businesses don't have a capital problem—they have a structure problem. Banks evaluate you using frameworks built for W-2 employees and Fortune 500 corporations. Strong assets but unconventional structure? You get declined. Tax write-offs make income look low. Denied. Profitable church with congregational giving instead of audited financials? Sorry.

Here's what lenders won't tell you: If you're running $500K to $20M in revenue and hold valuable assets—equipment, real estate, stock portfolios, investment properties—you likely qualify for substantial capital. Just not through conventional channels.

In this article, you'll discover the eight asset-based financing options that work when traditional banks say no.

WHAT IS ASSET-BASED FINANCING?

Asset-based financing is capital secured by what you own, not what your tax returns show or what your credit score says. Lenders evaluate specific collateral—commercial real estate, equipment, securities, cash-flowing properties—and advance funds based on asset value and equity position.

The fundamental difference? Traditional banks assess your personal financials first, then consider collateral as backup security. Asset-based lenders flip this. They start with the asset. Is there equity? Is it liquid? Can we secure our position? Your FICO score, debt-to-income ratio, and tax return complexity become secondary considerations.

It's financing based on what you control, not how you look on paper.

🔑 Key Takeaway: Asset-based financing evaluates collateral value first, personal financials second—making it accessible to businesses that banks typically decline despite having strong balance sheet assets.

WHY SMALL BUSINESSES USE ASSET-BASED FINANCING

Banks don't reject deals because your assets aren't strong—they reject them because your assets don't fit their policy templates.

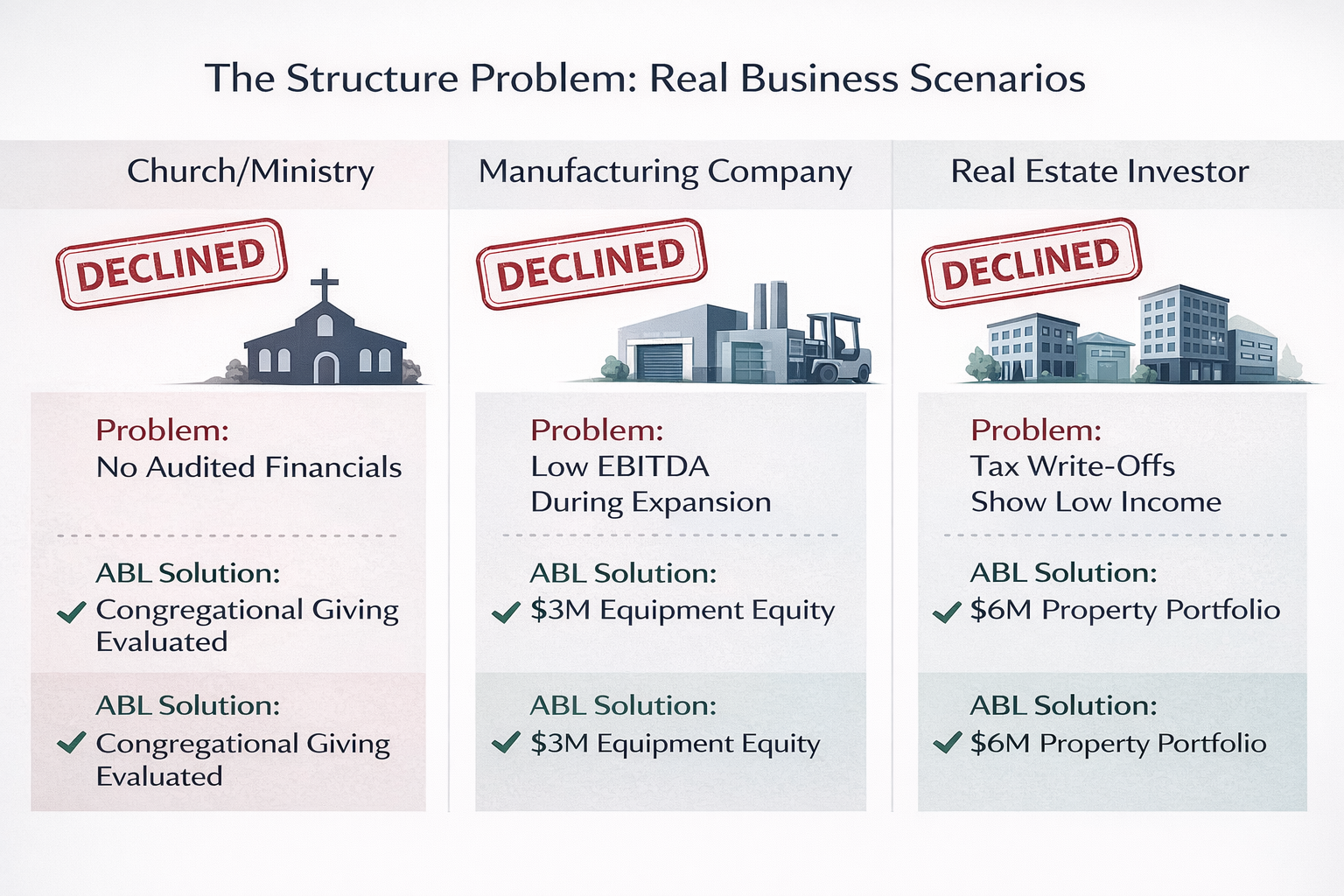

I've watched this pattern for 20 years. A church with $800K in annual giving gets declined because there are no audited financials. A distribution company with $3M in paid-off forklifts can't get approved because last year's EBITDA dipped during warehouse expansion. A real estate investor controlling $6M in properties gets denied because aggressive tax write-offs make W-2 income look weak.

The assets are there. The equity is real. The problem is structural.

Asset-based financing solves structure problems, not capital problems. When you don't fit the conventional box but hold valuable collateral, these lenders evaluate deals on economics and equity position—not policy checklists designed for different business models.

Sound familiar?

🔑 Key Takeaway: Traditional bank rejections usually signal a structure mismatch, not weak financials—asset-based lenders evaluate your actual collateral value rather than whether you fit their underwriting template.

THE 8 ASSET-BASED FINANCING OPTIONS FOR SMALL BUSINESS

OPTION 1: Church Real Estate Financing

Churches face a paradox. Growing congregations need facilities. Banks need audited financials, personal guarantees from board members, and income documentation that doesn't account for how faith-based organizations actually operate. I worked with a ministry last year—$1.2M in annual giving, 400-member congregation, zero debt. Traditional lenders wouldn't touch it.

Look for church lenders who underwrite on underlying financial strength. This type of Church real estate financing evaluates congregational strength, giving history, and ministry trajectory instead of conventional metrics. No audited financials required. No personal guarantees exposing pastors or board members to liability. No minimum FICO thresholds. These programs understand that a church's balance sheet looks nothing like a widget manufacturer's—and that's fine. Loan amounts typically range from $250K to $10M+ depending on property value and congregational capacity. Purchase, refinance, or construction—all structured around how ministries actually function.

OPTION 2: Second Mortgages for Business Owners

Here's what most business owners miss: You can access commercial real estate equity without touching your first mortgage. This matters when your existing rate is 4.5% and current refi rates are 7%+.

Second position loans let you borrow against property equity while preserving your favorable first mortgage. Works on any cash-flowing property—office buildings, retail centers, industrial facilities, mixed-use developments, investment properties. The math: Property worth $2M with a $1M first mortgage at 65% combined loan-to-value means $300K available capital without refinancing.

Available nationwide. No minimum FICO requirement. $100K to $3M loan amounts. Typically funded in three to four weeks. I've closed these for business owners needing acquisition capital, equipment purchases, debt consolidation, or bridging seasonal cash flow gaps. Your building has equity. Use it without blowing up a great first mortgage rate.

OPTION 3: Equipment Secured Term Loans & Lines of Credit

Manufacturing, distribution, construction, transportation—these businesses often have millions in equipment equity sitting idle on balance sheets. A construction company I worked with owned $4M in excavators and dozers outright. Cash flow was tight during a project gap. Banks wanted 750+ FICO and strong EBITDA. We secured $1.8M against the equipment in 19 days.

Equipment-secured financing works two ways. Term loans provide lump-sum capital for specific needs—expansion, acquisitions, major purchases. Revolving lines let you draw funds as needed and pay down as cash flow allows, similar to a credit card but secured by machinery.

Unlike traditional equipment loans requiring pristine financials, these evaluate asset value. Companies use this capital for growth, seasonal inventory, payroll bridging, or working capital during margin compression. Your equipment already exists. Turn it into accessible capital.

OPTION 4: Equipment Sale-Leasebacks

Most overlooked capital source in small business: Sell equipment you own outright, then lease it back under favorable terms. You generate immediate cash. Operations don't skip a beat. You continue using the same machinery under a lease agreement structured around your cash flow.

A metal fabrication shop had $2.8M in paid-off CNC machines. Needed $1.9M for a competitor acquisition. We structured a sale-leaseback—they got the capital, leased the equipment back at competitive rates, closed the acquisition. Twenty-three days start to finish.

This works when you've tied up too much capital in equipment purchases and now need liquidity for opportunities, debt payoff, or operational needs. The equipment becomes a financing tool, not just a production asset. Transactions typically close in 21-30 days.

OPTION 5: Equipment Financing & Leasing

New equipment costs real money. Tying up cash reserves or credit lines to buy it outright creates opportunity cost—that capital could fund marketing, hiring, or inventory instead.

Equipment financing provides 100% financing on new or used assets—machinery, vehicles, technology, specialized equipment. Unlike bank loans demanding 20% down and perfect credit, these programs evaluate the equipment itself as primary collateral. A landscaping company needs three new mowers at $180K total. Banks want $36K down. Equipment financing? Zero down, structured payments matching seasonal revenue.

Options include capital leases (rent-to-own), operating leases (true rental with return option), or term loans secured by the equipment. Payments can be monthly, quarterly, or seasonal. Works for construction equipment, medical devices, restaurant buildouts, manufacturing machinery, delivery fleets—anything with resale value.

OPTION 6: Stock-Secured Loans (Securities-Based Lending)

High-net-worth business owners and executives holding substantial publicly traded stock portfolios face a dilemma. Selling shares triggers capital gains taxes. Not accessing the wealth leaves opportunities on the table.

Stock-secured loans let you borrow 50-70% of portfolio value using securities as collateral. No credit check. No personal guarantee. No income verification. A founder I worked with held $8M in company stock post-IPO. Wanted to acquire a competitor for $3.5M. Selling stock meant $800K+ in taxes. We secured a $4M stock loan—he funded the acquisition, kept his equity position, avoided the tax hit.

Particularly valuable for concentrated positions, executives in lockup periods, or investors preserving stock appreciation while accessing capital for business investments, real estate, or other opportunities. Loan amounts typically start $1M and can reach $50M+ for large portfolios.

OPTION 7: Non-QM Loans for Business Owners

Self-employed business owners live this frustration daily. Business is profitable. Cash flow is strong. Tax returns show $60K income because your CPA correctly maximized write-offs. Traditional mortgage lenders see the $60K and deny you.

Non-Qualified Mortgage (Non-QM) loans evaluate income differently. Bank statement programs analyze 12-24 months of business deposits—they see actual cash flow, not tax-optimized income. Profit & loss programs use CPA-prepared financials. DSCR (Debt Service Coverage Ratio) loans qualify purely on rental property cash flow with zero personal income verification.

Foreign nationals access financing with no U.S. credit history required. A real estate investor I worked with—1099 income, six rental properties, wrote off everything legally possible. Tax returns showed $48K. Bank statements showed $280K in deposits. Non-QM lender approved based on actual cash flow, not paper income.

OPTION 8: Investor & Commercial Real Estate Financing

Speed kills deals. Traditional banks take 60-90 days for commercial real estate approval. You're competing against cash buyers closing in two weeks. You lose.

Bridge loans close deals in 14-21 days when timing matters. Portfolio loans finance multiple properties under one structure when individual banks won't handle complex holdings. Alternative commercial lenders evaluate property fundamentals—location, cash flow, tenant strength, exit strategy—rather than requiring perfect personal financials.

Last month, a developer found a $3.2M mixed-use property. Seller needed to close in 18 days for 1031 exchange timing. Traditional banks couldn't move that fast. We structured bridge financing, closed in 16 days. He later refinanced into permanent financing after renovation.

Particularly valuable for acquisitions, value-add repositioning, construction, or any deal where timing creates competitive advantage.

🔑 Key Takeaways:

Churches, equipment-heavy businesses, stock portfolio holders, and self-employed owners each face unique financing barriers that asset-based options specifically address

Multiple programs can be layered—second mortgages for major capital, equipment lines for ongoing flexibility

Speed and structure often matter more than rate when opportunities have tight timelines

HOW TO CHOOSE THE RIGHT OPTION

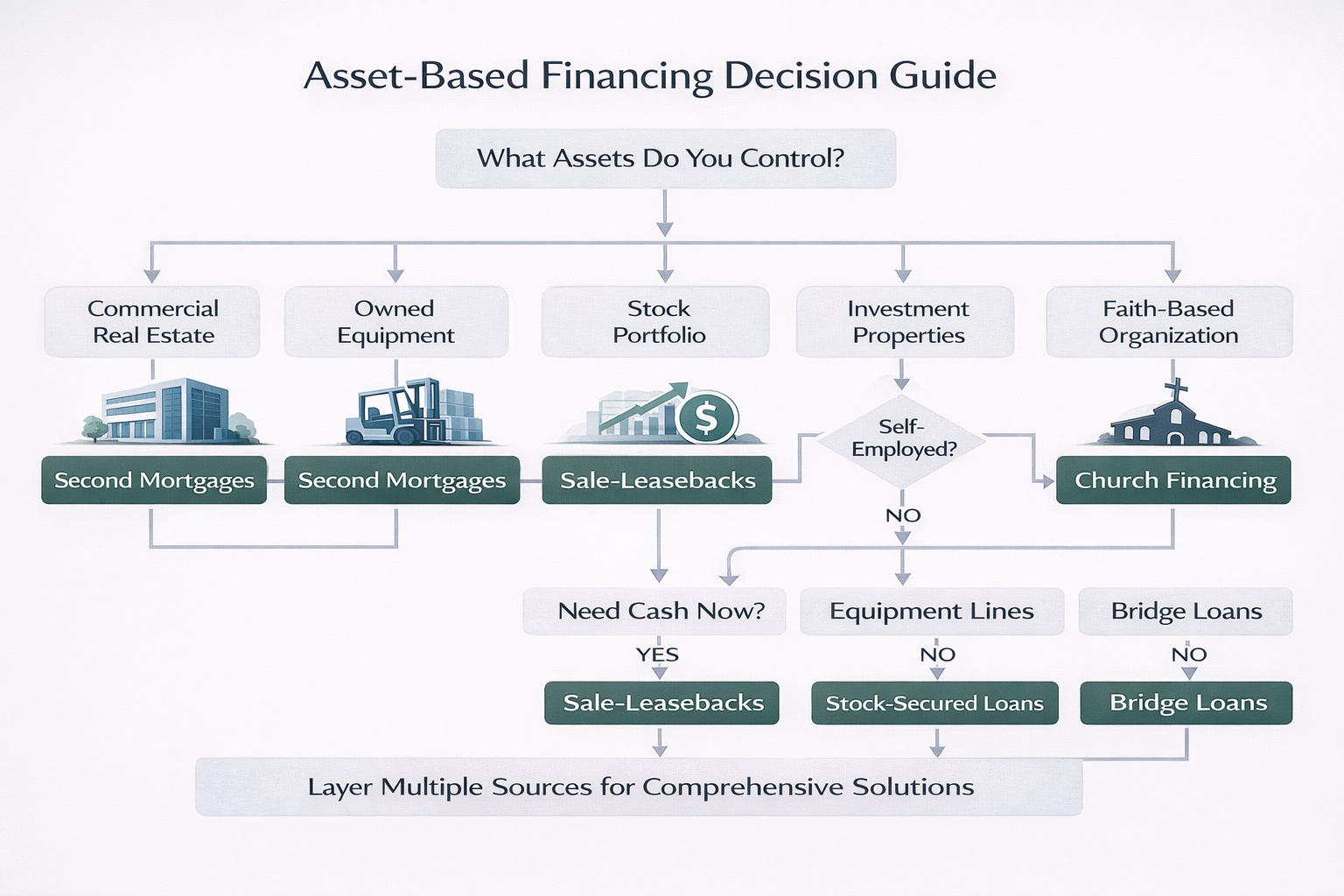

The right asset-based financing option depends on three factors: what assets you control, your capital timeline, and your intended use of funds.

Quick assessment. Own commercial real estate with equity? Second mortgages unlock that capital without refinancing. Own equipment outright but need working capital? Sale-leasebacks convert machines to cash. Self-employed with investment properties? Non-QM or DSCR loans ignore tax returns and evaluate actual cash flow. Hold a stock portfolio but need business capital? Stock-secured loans preserve your equity position. Church or ministry? Specialized programs exist that understand congregational economics.

Here's the reality most businesses miss: You can layer multiple sources. A second mortgage funds major expansion. An equipment line provides ongoing operational flexibility. Most of my engagements start with a balance sheet asset review, not a loan application.

We find what you already own, then structure capital around it.

🔑 Key Takeaway: Asset-based financing isn't one-size-fits-all—the optimal structure combines what you own, when you need capital, and what you'll use it for, often layering multiple sources for comprehensive solutio

RAVENBANQ DIFFERENTIATION

Ravenbanq operates as an asset-based capital advisor, not a lender or broker. We don't push single products or represent one funding source. We align structure, timing, and asset strategy across multiple capital sources to match your specific situation.

I've closed $250M+ in asset-based transactions over 20 years. Worked under NYC Mayor Bloomberg partnering with Fortune 500 brands. I've seen deals structured brilliantly and watched others collapse from preventable mistakes.

We identify opportunities in your balance sheet that single-lender shops and rate-quote brokers miss entirely.

🔑 Key Takeaway: Independent advisory beats single-lender or broker relationships—we optimize across all eight asset-based options simultaneously, not just the programs one lender offers.

NEXT STEPS

If your business holds underutilized assets—paid-down real estate, owned equipment, stock portfolios, investment properties—an advisory review often uncovers capital you didn't know was accessible.

Most engagements start with a balance sheet asset review, not a loan application. We identify what you own, then structure financing around it.

Schedule a complimentary asset review: [corey@ravenbanq.com or call 407-255-2542]

Corey Rockafeler is CEO and founder of Ravenbanq, an asset-based financing advisory specializing in small business capital optimization.

As an asset-based financing expert with 20+ years of experience in asset-based lending, commercial finance, and structured capital—having closed $250M+ in transactions—Corey previously served as a top business development executive under NYC Mayor Bloomberg, partnering with Fortune 500 corporations including Google, Time Warner, Whole Foods, and Mandarin Oriental on economic development initiatives.

Connect with Corey on LinkedIn: [LinkedIn URL]