Here's a question that separates $10 million businesses from $2 million ones: When was the last time you changed operations because of something you saw coming, not something that already hit you?

Most operators excel at reacting. Problem shows up, they solve it. That keeps you alive. It doesn't make you grow.

I just watched a business owner lose a $2.3 million contract to a competitor who made one strategic change eighteen months ago. Same industry. Similar capabilities. One saw the shift early. The other is still wondering what happened.

After over twenty years financing businesses across every sector, I've learned something counterintuitive: the best operators aren't visionaries. They don't predict the future.

They're just disciplined about watching what's already changing and moving before it becomes urgent.

The gap between early movers and late reactors isn't closing. It's accelerating. And 2026 is the year that gap becomes impossible to ignore.

The 10 Trends That Will Define Your 2026

These trends cut across technology, workforce dynamics, capital access, and operational strategy. Will every single one apply to your business?

No. But I guarantee at least three are already impacting your bottom line whether you've noticed or not.

Miss the ones relevant to your industry, and you're looking at six-figure consequences—lost contracts, talent walking out the door, opportunities your competitors grab while you're still figuring out what changed.

Experienced operators aren't trying to master all ten. They're identifying which two or three matter most for their specific situation and moving decisively on those.

1. AI Stopped Being Optional

A manufacturer I work with just lost a $400K contract. The competitor responded to the RFP in four minutes with a detailed quote. My client took two days because his estimator was on vacation.

Four minutes versus two days. The competitor used AI—automated quoting system that pulled specs, cross-referenced inventory, generated a proposal. Done.

That's where we are. AI isn't some future consideration. It already decided who won that contract.

Your customers expect instant responses now. Order tracking without phone calls. Systems that remember their preferences. If your competitor delivers and you're manually doing everything? You look slow.

Back office tells the same story. Scheduling, bookkeeping, inventory updates—businesses hitting $10 million aren't drowning in admin staff. They automated repetitive tasks years ago.

The numbers? Companies using AI for customer service cut response times 30-40%. Those automating admin work free up ten hours weekly per employee.

Ten hours. What could your best people do with an extra ten hours?

Stop waiting for perfect. Your competitors aren't.

Key Takeaways:

Pick one thing this quarter—automate quoting, customer service, or bookkeeping

AI separates winners from losers today, not someday

Customers expect it; you're losing deals without it

2. The Talent War Changed Shape

The hiring crisis didn't end. It just stopped being about money.

A logistics company lost their best operations manager last month. Competitor offered $8K more annually. Sounds straightforward?

Wrong. The real reason? Three remote days weekly versus five days in-office.

$8K didn't matter. Flexibility did.

Workers stopped chasing pay bumps. They want flexibility, growth, and work that doesn't feel pointless. Skills-based hiring overtook degrees. A developer with a portfolio beats a CS degree with no projects.

Turnover costs 1.5-2x annual salary. Recruiting, onboarding, lost productivity. Businesses stuck in old playbooks pay repeatedly.

Flexibility costs nothing. Replacing good people costs everything.

Key Takeaways:

Workplace flexibility is cheaper than turnover—offer it

Invest in development to keep people, not just attract them

Proven skills beat credentials—rethink requirements

3. Capital Access Split Into Two Worlds

Banks stopped lending to the middle. If you're doing $500K to $20M in revenue, you know this.

They want perfect financials. Pristine ratios. Collateral fitting exact templates. One tough quarter? Denied. Tax write-offs lowered reported income? You don't fit the box.

Alternative lenders stepped in. Asset-based financing, revenue-based lending, equipment lines. They evaluate what you own and how cash flows, not tax returns.

A distribution company got turned down by two banks. Needed $750K for inventory. Third bank also said no. Asset-based lender approved them in eleven days using paid-off forklifts as collateral.

Same business. Different lender, different result.

The operator knowing only traditional banking? Limited options. The one knowing alternatives? Moves when opportunity shows up.

Key Takeaways:

Learn alternatives before you desperately need them

Structure and speed often matter more than rate

Multiple capital sources give you leverage

4. Customer Acquisition Costs Broke Business Models

Facebook ads used to work. Spend $50, get three customers, make $400.

Not anymore.

Digital ad costs jumped 30-40% while organic reach collapsed. Posts that hit 10,000 people now reach 300. Paid acquisition? You're spending $200 to get a customer worth $150.

That's not growth. That's bleeding money.

What works now? Community. Retention. Referrals. Lifetime value.

A Texas service company cut acquisition spending 40% and reinvested in customer experience. Faster responses, better follow-up, loyalty rewards.

Six months later: referral rates doubled, customer lifetime value jumped 60%. Same revenue, better margins, sustainable.

Businesses dumping money into broad campaigns are getting crushed. The ones building communities and optimizing retention? Winning quietly.

Retention always cost less. We forgot when ads were cheap.

Key Takeaways:

If CAC rises faster than LTV, your model is broken

Retention beats acquisition—invest accordingly

Build referral engines and community, not ad campaigns

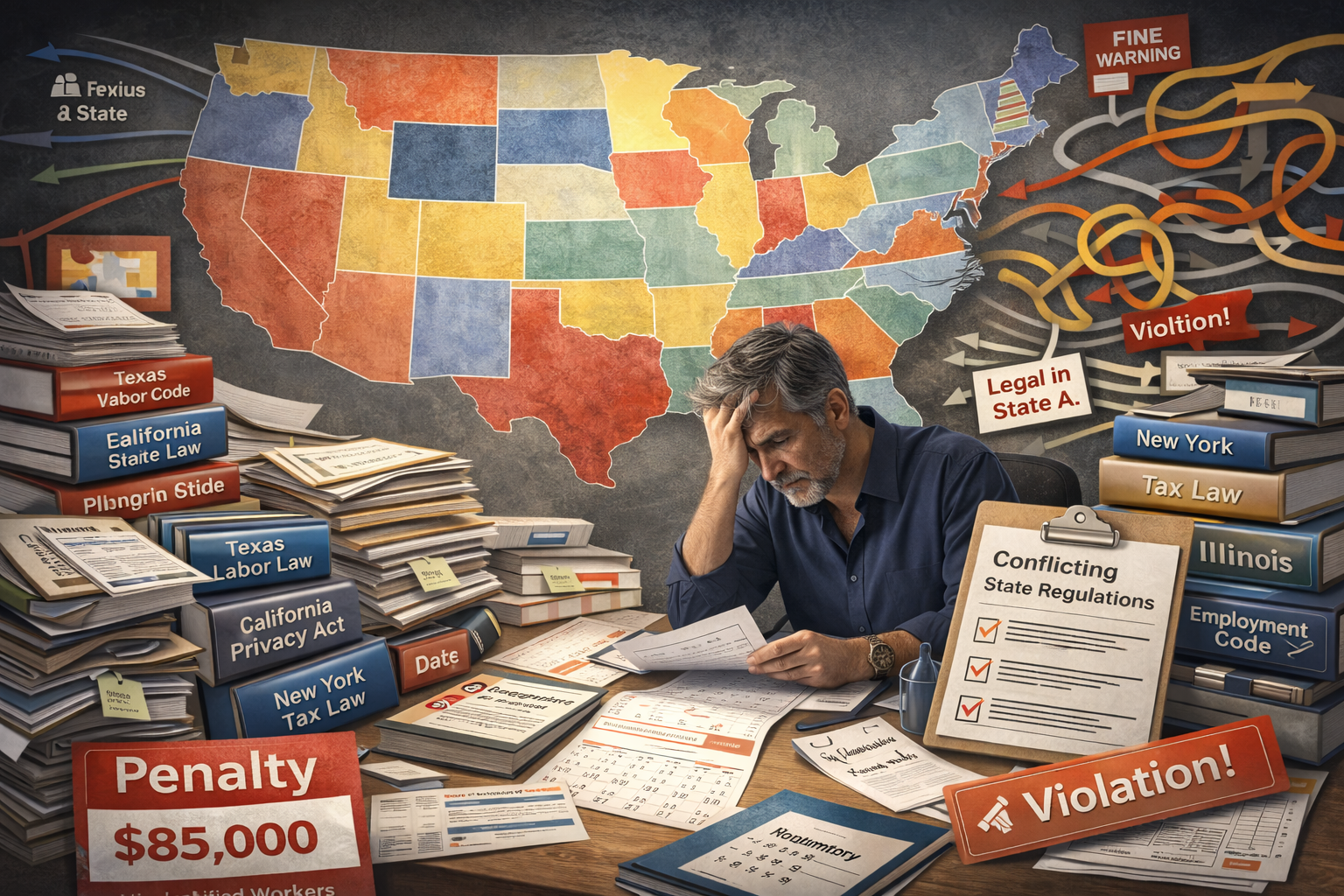

5. Regulatory Complexity Accelerated

State regulations diverged faster than anyone expected. Labor laws, privacy rules, tax codes—what's legal in Texas isn't in California or New York.

Multi-state operators face compliance nightmares that didn't exist five years ago.

Penalties got aggressive. The "we didn't know" defense? Doesn't work anymore. A Colorado contractor expanded into California without checking local labor laws. Got hit with $85K in fines for misclassified workers.

Growing into new states now requires legal planning upfront, not reactive fixes after violations.

Budget for compliance if you're multi-state. Don't assume what works in one place transfers automatically. Ignorance became expensive in 2026.

Key Takeaways:

Multi-state operations need dedicated compliance resources—budget for it

State regulations diverged dramatically—don't assume portability

Proactive compliance costs less than reactive penalties

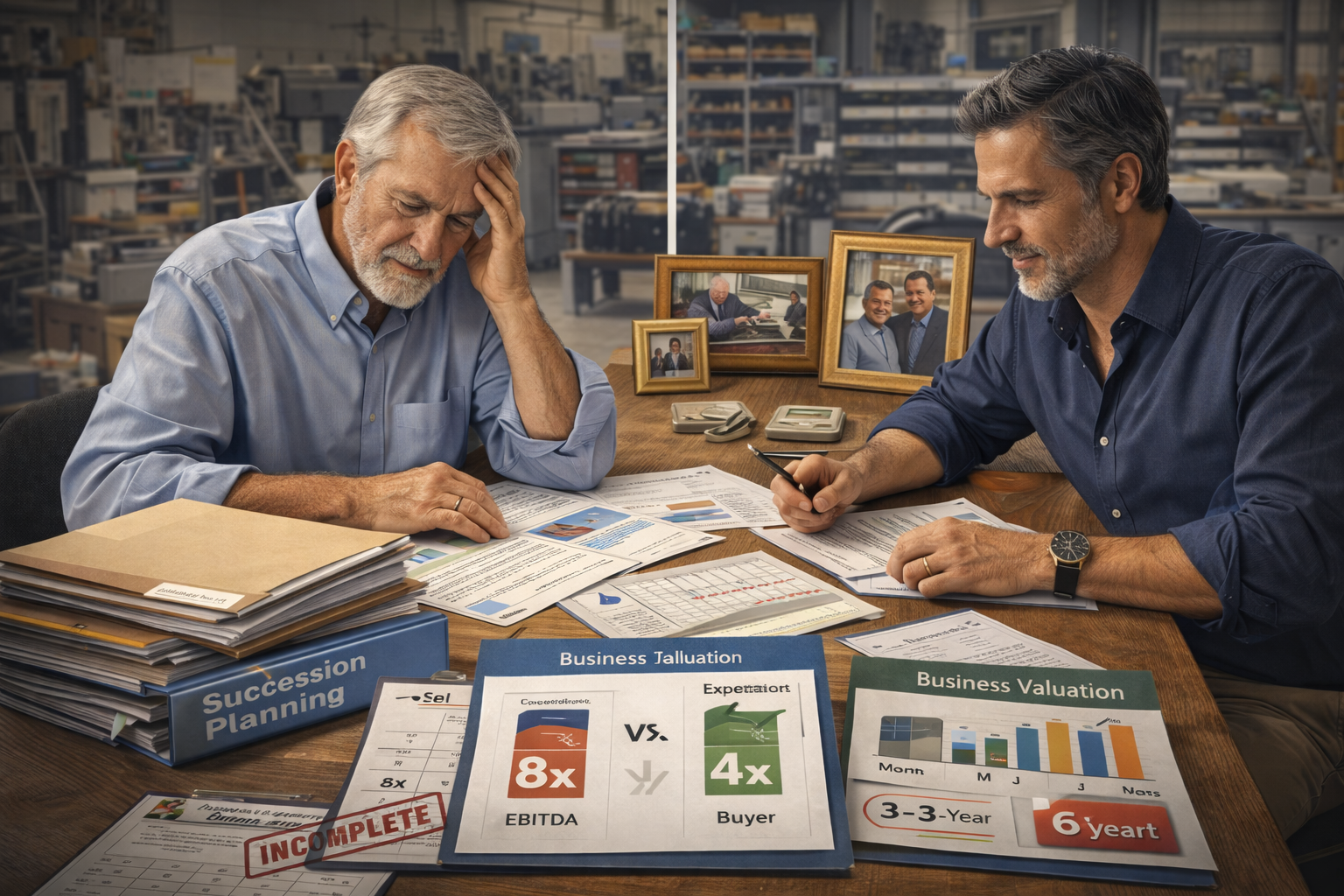

6. Generational Transition Hit Critical Mass

Seventy percent of family businesses will change hands within the next decade. Boomers are exiting. Millennials and Gen Z are taking over.

Buyer-seller expectations? Completely misaligned.

Exit planning takes 3-5 years, not six months. Sellers remember deals structured one way. Buyers expect different terms today.

A manufacturing business owner I know assumed his son would just "take over when ready." No valuation, no transition plan, no operating agreement. Son wanted equity immediately, not after Dad retired. Deal nearly collapsed.

Succession isn't paperwork. It's strategic, emotional, and financially complex.

The generation taking over brings different operating assumptions. What worked for 30 years won't survive the transition without deliberate planning.

Key Takeaways:

If you're 55+, start exit planning now—even if you're not selling soon

Buyers and sellers are misaligned on structure—education matters

Succession planning is strategic, not administrative

7. Supply Chain Resilience Became Competitive Advantage

Single-source suppliers are now high risk. Post-pandemic lessons stuck.

Inventory strategies shifted from "just in time" to "just in case." Nearshoring and supplier diversification became standard.

Small businesses can't absorb shocks like Fortune 500 companies. That makes resilience critical.

Build relationships with 2-3 suppliers, not one. Understand your critical dependencies. A small buffer inventory costs money but saves more when disruptions hit.

A furniture maker relied on one Chinese supplier. Container delays killed Q4 sales. Next year? Two backup suppliers, one domestic. Costs rose 8%. Lost sales dropped to zero.

Supply chain disruptions aren't over. They're permanent. Redundancy costs less than lost sales.

Key Takeaways:

Supply chain disruptions are permanent—plan accordingly

Supplier redundancy costs money but saves more during disruptions

Know your critical dependencies cold

8. Customer Experience Became the Differentiator

When products commoditize, service separates winners from losers. Most industries face product parity now.

Speed, responsiveness, personalization—these matter more than ever.

The "Amazon effect" raised expectations everywhere. People expect seamless experiences whether buying shoes or hiring contractors.

Small businesses have an advantage here. You can out-service big competitors. Personal touch scales better than corporate bureaucracy. Loyalty built on experience outlasts price competition.

A Michigan HVAC company invested in same-day service guarantees and post-appointment follow-ups. Referral rates jumped 45%. Customer lifetime value increased 35%.

Service became their moat.

Key Takeaways:

Compete on experience when you can't compete on price

Responsiveness beats perfection in most customer interactions

Small businesses win on relationship depth—use that advantage

9. Economic Uncertainty Became Permanent

Interest rates, inflation, geopolitical risk—none of it is going away.

Operators who "wait and see" get beat by those who adapt quickly.

Building resilient operations means maintaining 3-6 months cash reserves. Keep cost structures flexible where possible. Use scenario planning instead of rigid annual budgets.

A Pennsylvania manufacturer built variable cost structures using contract labor during peak seasons. When demand softened, costs adjusted automatically. Competitors with fixed overhead struggled.

Don't freeze in uncertainty. Your competitors won't. Adaptability matters more than prediction.

Key Takeaways:

Build 3-6 months operating cash reserves minimum

Flexible cost structures beat fixed overhead in volatile markets

Scenario planning beats rigid annual budgets

10. Technology Debt Caught Up

Legacy systems became liabilities. Outdated software creates operational drag. Integration failures waste time. Cybersecurity risks multiply with aging infrastructure.

Cloud-based tools aren't optional anymore. API integrations reduce manual work. Security can't be an afterthought.

A distribution company ran operations on a 15-year-old system. Data entry took hours daily. Customer orders got lost. They finally migrated to cloud-based software.

Manual work dropped 60%. Order accuracy jumped to 99%. Customer complaints disappeared.

Audit your tech stack. What's holding you back? Invest in systems that integrate, not isolated tools.

Cybersecurity breaches cost more than prevention.

Key Takeaways:

Audit your tech stack—identify what's creating drag

Invest in integrated systems, not isolated tools

Cybersecurity breaches cost more than prevention

Conclusion: The Pattern You Can't Ignore

Twenty years financing businesses taught me one thing: winners don't wait for certainty.

They see change coming and move while everyone else is still debating whether it's real.

These ten trends aren't coming—they're here. Your competitors are already adjusting. They're automating customer service. Building referral engines. Diversifying suppliers. Planning exits. Moving capital faster.

You don't need all ten. Pick two that hit your business hardest. Act this month, not next quarter.

The businesses that win 2026 won't be the smartest or best-capitalized. They'll be the ones who recognized what changed and did something about it while others were still reacting to last year's problems.

Which trend matters most to your business? And what's stopping you from addressing it right now?

Ready to Move on These Trends?

Most business owners I talk to realize they're sitting on opportunities they didn't know existed. Not because the opportunities weren't there—because nobody showed them what to look for.

If you're running a $500K-$20M revenue business and any of these ten trends hit home, the question isn't whether you should act. It's which one you tackle first.

Corey Rockafeler has spent over twenty years helping operators structure capital around what they already own—equipment, real estate, securities, cash-flowing assets. Most conversations start with a simple question: what's sitting on your balance sheet that could be working harder for your business?

Not a loan application. Not a pitch. Just an honest look at what you control and whether it could fund the move you've been waiting to make.

Contact: corey@ravenbanq.com | 407-255-2542